If you’re a business owner and you’re realizing you need to hire a few employees, congratulations! It means your business is flourishing. But, expanding from a one-person operation to a small company means you’ll have more things to learn and more tasks to handle. As the saying goes, with great power comes great responsibility. Now, you’re not only the founder and CEO, but you’re also in charge of payroll. That means you’ll need to learn how to make a paystub. Read on to learn what information you need and how to build an official paycheck stub.

Gather the Right Information

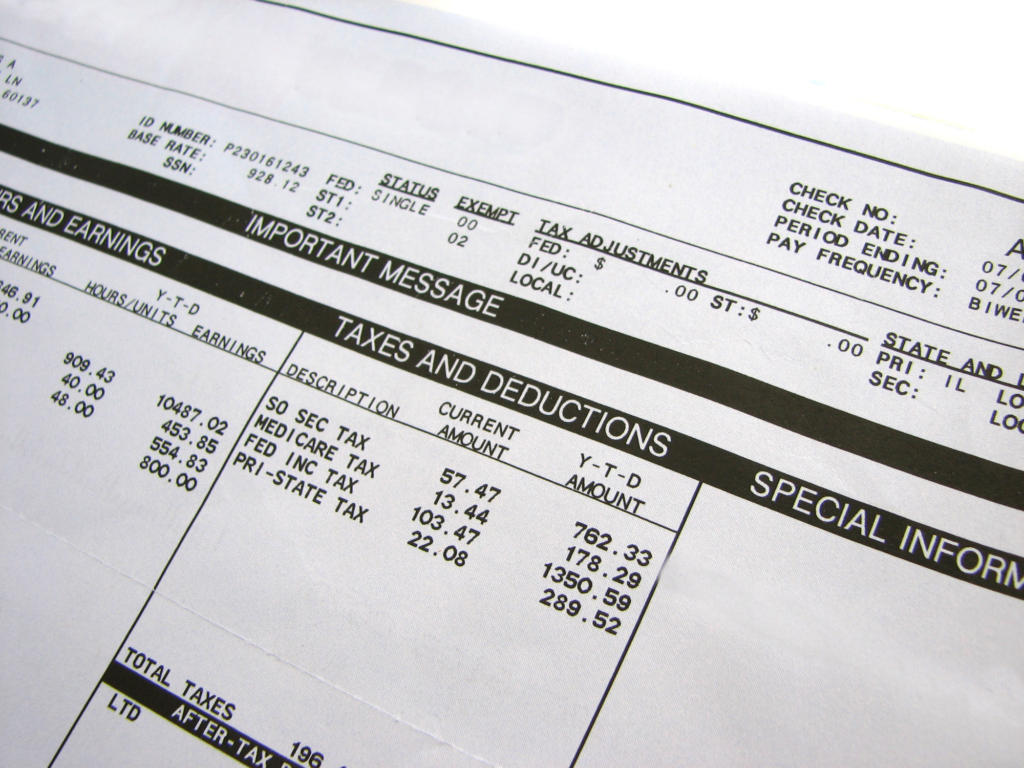

The top of a paycheck stub needs to include the name of the company and its contact information. It should also include the employee’s full name and their Social Security Number. Also, be sure to list the date the paycheck was created and the work dates for the pay period. The gross income, which is the employee’s earnings before deductions, should be near the top of the paycheck stub. Deductions will show the taxes and other fees that were withheld from the paycheck. These deductions will go towards state and federal taxes, retirement contributions, health insurance premiums, Social Security, and Medicare. Net pay or take-home pay will show the employee how much money they’ll get in their bank account. This total is usually at the bottom of a paystub.

How to Make a Paystub: 3 Ways

When it comes to formatting your paycheck stub, you generally have three options. You can make your own custom template using a spreadsheet like Excel. This option will give you complete control over how the paystub looks. But, it may be more time-consuming since you have to create it from scratch. An online check stub maker like PayStubCreator will streamline the process for you. You’ll normally be charged a fee to use a tool like this, but they often include customer service. You’ll have more peace of mind with this option. You can also download a paystub template and use it with a word processor like Word. These templates are often free but can be difficult to customize. But, if you need a basic format and have a limited budget, this option might work for you.

Consult With an Accountant

When you’re in charge of a growing business, it can feel like you have three jobs: business owner, supervisor, and accountant. It can be overwhelming. It’s also a challenge to know how much tax money you need withhold from your employees’ checks. For example, state taxes are different in every state. Tax requirements also change from year to year. Plus, if you don’t follow the employment tax laws, you can be turned into the IRS or face a criminal or civil penalty charge. That’s why it’s a good idea to meet with an accountant who specializes in tax law. Make sure to choose an accountant based in the same state as your business because they will know the state’s tax requirements. Meeting with an accountant will give you peace of mind that your tax calculations are correct.

Make Your First Paycheck Stub Today

When you have employees, the most important thing to do is pay them. But, a paystub can be just as important as a paycheck. Your employees will need a payslip to apply for a loan, sign a lease, and keep track of their personal finances. Plus, if an employee ever has a question about payroll, you’ll have a record. Paycheck records are as helpful to you as a business owner as they are to your staff. Now that you know how to make a paystub, you’re on your way to becoming the world’s best boss. For more ways to help your business run smoothly, check out our HR category.