If you have applied for a business loan (or plan on applying), you know the essential thing to today’s lenders is your credit score. This number, which ranges between 300 and 850, speaks volumes about your ability to manage your money and make your payments. Stated by a credit repair Dallas expert, your credit score not only affects whether lenders will let you borrow money, but it also affects your interest rates, insurance costs, and employability. Did you know that? It is important to know your credit score and to keep close tabs on it. The technical name for a credit score is your FICO score. The number is fluid and can easily be improved or worsened with a few simple adjustments to your financial behaviors.

How FICO Credit Scores are Labeled

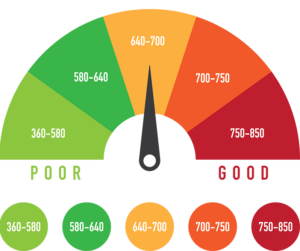

The top credit score is 850, and the worst is 300. The ones in the middle are rated as excellent, good, fair, and poor.

- If you have a score between 750 and 850, your credit is excellent, and you will be able to get nearly any loan you want with the lowest interest rates.

- Scores between 700 and 749 are good, which will result in lenders approving loans but possibly assigning slightly higher interest rates than the above scores.

- If your score is between 650 and 699, your credit is fair, so you might be declined for unsecured loans, or you will be given higher interest rates.

- If your credit is below 650, you will struggle to get loans, even secured ones. At this point, we recommend waiting to apply for a loan until you can improve your credit score.

Factoring Credit Scores

When you understand how FICO factors your credit score, you will have an easier time improving your score. Five factors impact your score. These are:

Payment History

- Debt-to-Credit Ratio

- Credit History Length

- Type of Credit

- New Accounts

These factors are not treated equally. The most important factor is your payment history, which involves how often you have late payments or if you have ever filed for bankruptcy. The next factor that affects your credit score is debt-to-credit ratio, which includes how much available credit you have compared to how much you have used. It is highly recommended to keep this at 30% or less of your overall credit limit. The next two include what type of loans you have and how long you have had it. Finally, and least importantly, the credit score includes your newest credit and how often you apply for new accounts.

How to Improve Your Credit Score

If you have a good or excellent credit score, you want to maintain it. If your credit score is fair or poor, you should make a concerted effort to improve it. When you know what matters to credit bureaus and how they factor scores, you should start with the most critical component: paying on time.

Don’t Be Late

For creditors and lenders, borrowers paying on time is essential. If you have payments that are at least 30 days late, creditors will report those to the three bureaus. Even one late payment can affect your score. So, if you can change anything, change the timing of your payments. Whether you pay the minimum, the full balance, or something in between, send the payment on time.

One of the best ways to be sure your payment is made on time is to set up automatic payments. Most creditors offer automatic payments online, and many banks offer the benefit, too. When you set up an automatic payment, you won’t miss it. Just be sure that your account has enough to cover the amount.

Minimize Debt-to-Credit Ratio

The second factor that affects your credit score is the amount of credit you use. There are a few ways to do this. One is to stop using your cards, and the second is to pay off what you owe. If you have maxed your credit cards, then your credit score will be low. You want to use as little of your available credit as possible.

When you pay down your biggest accounts, your credit score will be sure to improve. If you cannot afford to pay down your credit cards entirely, you might want to consider a consolidation loan to lower your ratio. Some banks offer these for people who have shown they can pay their loans but have too many individual accounts.

To keep the ratio at a desirable level, pay cash as often as possible. Only use your credit cards when nothing else is available. And, if you must use your credit cards, pay each balance as soon as possible.

Some people use their credit cards to earn perks, but they never pay interest because they pay off their balances immediately. People call this “living within their means,” and they buy only what they can afford to pay for in cash.

Build a Long Credit History

This is tough to do if you are new to the world of credit. Everyone had to start somewhere. So work on having an account that you use, but do not overextend. Your history will improve as you buy a car every few years, or if you buy a house and regularly make your mortgage payments. Also, it is best not to close old accounts. Keep them, so you have available credit and credit history.

Be Mindful of the Credit You Choose

Each time that you apply for new credit, the lenders have to report your request to your credit bureau. While it is good to have a mix of revolving, installment, and mortgage credit, you do not want to have too many new accounts. Lenders do not look favorably on this behavior. However, if you have several accounts that you do not use, your credit utilization ratio will be low – lenders like this.

The best thing to do is to only apply for credit when you need it. Then, when you do apply for it, choose your new accounts wisely. If your credit is good, you can get the lowest interest rate and the best terms. You can get cards with outstanding perks, but you shouldn’t overuse them.

As you choose credit, avoid anything with annual fees, so you don’t have unexpected payments to make. It is also wise to avoid getting store credit cards, especially since they have high-interest rates and low limits, which can impact your debt-to-credit ratio. With all financial accounts, knowledge is power. Understanding how credit scores are factored, you can improve your score and your financial life.

- How Businesses Can Attract Customers Through Financing - March 5, 2024

- Credit Reporting Made Easy: Elevating Investor Qualification Efficiencies - January 17, 2024

- How to Develop a Comprehensive Safety Plan for the Workplace to Improve Productivity - June 28, 2023

Payment History

Payment History